Don’t Let UK Tax Rules Trip You Up: Essential Planning for Expats!

Hey there, fellow expats in the UK! Navigating life in a new country is exciting, but let’s be real – dealing with a whole new tax system can feel like trying to solve a Rubik’s cube blindfolded. If you’re an expat living or working in the UK, understanding your tax obligations isn’t just a good idea; it’s absolutely crucial to avoid headaches, penalties, and sleepless nights. That’s where specialist tax planning services come into play, making sure your finances are in tip-top shape!

Why Expats Need Specialist Tax Planning

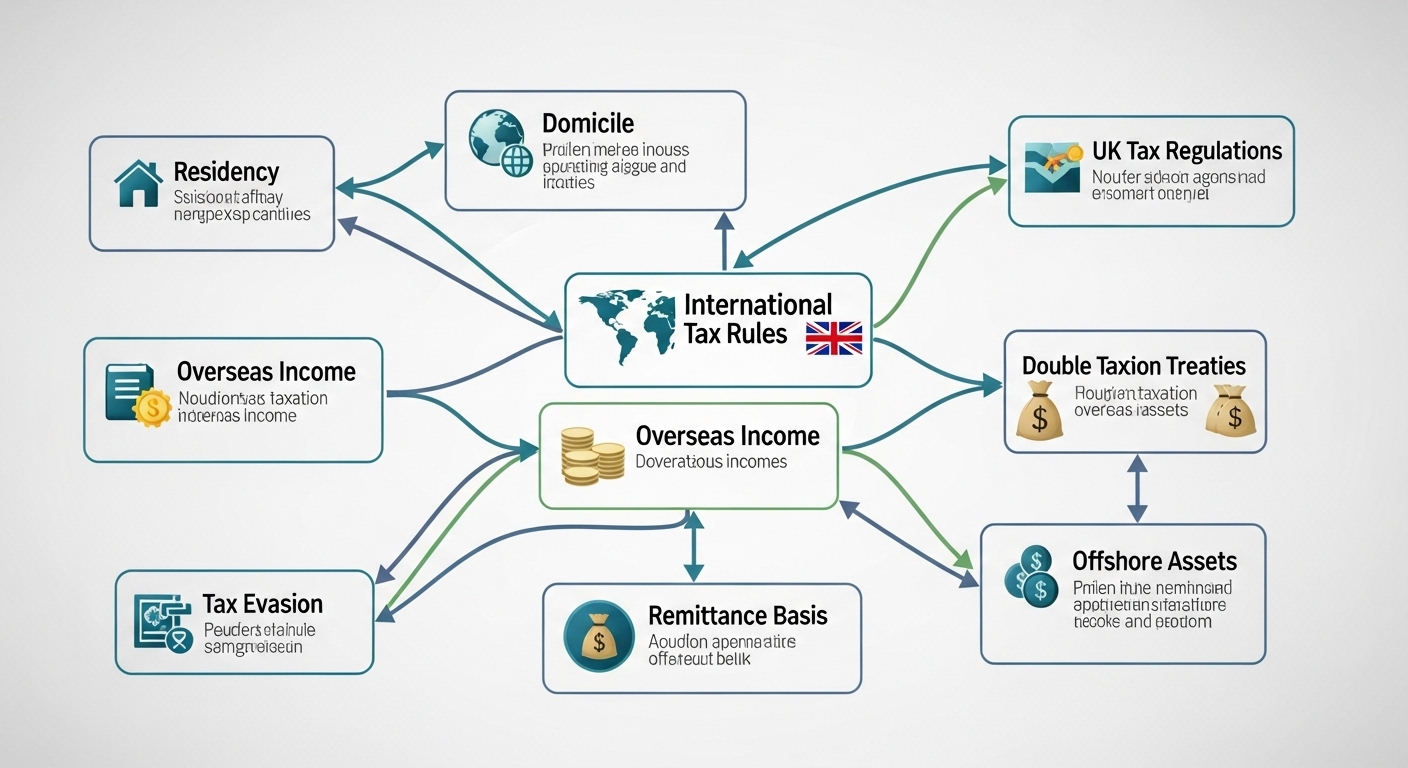

Moving to the UK means stepping into a tax landscape that’s different from your home country. What might have been straightforward before can suddenly become incredibly complex. You’re not just dealing with income tax; there are nuances around residency, domicile, overseas assets, and more that can seriously impact your wallet.

The Complexity of UK Tax for Non-Doms

Are you considered ‘domiciled’ in the UK or not? This isn’t just a legal term; it’s a game-changer for your tax status. Non-domiciled individuals often have different rules regarding their overseas income and capital gains. Without expert guidance, you might accidentally pay more tax than you need to, or worse, miss reporting something vital. It’s a minefield, and you need a guide!

Avoiding Nasty Surprises (and Penalties!)

Nobody wants a letter from HMRC demanding unexpected payments or slapping them with fines. Unfortunately, this is a real risk if you misunderstand your tax obligations. Specialist tax planning helps you proactively manage your tax affairs, ensuring compliance and peace of mind. Imagine how much better you’ll sleep knowing everything is sorted!

What Do Tax Planning Services for Expats Cover?

So, what exactly do these amazing services do? A good tax advisor will look at your entire financial picture to create a strategy that’s tailored just for you.

Income Tax and Residency Rules

Are you a tax resident? What about your employment income, pensions, or rental income from back home? An advisor will clarify your residency status and explain how different income streams are taxed in the UK.

Capital Gains Tax (CGT)

Selling property, shares, or other assets? CGT can be complex, especially with international assets. Experts help you understand your liabilities and explore any available reliefs or exemptions.

Inheritance Tax (IHT)

It’s not just for the super-rich! IHT can affect anyone with significant assets, and for expats, the rules around domicile can have a huge impact. Planning ahead can save your loved ones a lot of hassle and money down the line.

Overseas Income and Assets

This is often the trickiest bit! Whether it’s rental income from a property abroad, foreign investments, or pension funds, an advisor will ensure you’re reporting everything correctly and taking advantage of any double taxation agreements.

Choosing the Right Tax Advisor

Don’t just pick the first name you see! You need someone who truly understands the expat experience.

Look for Experience with Expats

Your tax situation is unique because you’re an expat. Find an advisor who specialises in international tax and has a proven track record of helping people just like you. They’ll know the ins and outs of both UK and international tax laws.

Transparency and Communication are Key

Make sure your advisor is clear about their fees and how they’ll communicate with you. You want someone who can explain complex topics in a way you understand and is always available to answer your questions.

Seriously, don’t try to navigate the labyrinth of UK tax laws on your own. Investing in expert tax planning services now can save you a ton of stress and money in the long run. Get in touch with a specialist and enjoy your expat life in the UK with one less thing to worry about!”